トップ ビジネス・経済 Inflation-indexed Securities ビジネス・経済

¥6,035

(税込) 送料込み

最終更新 2024/07/13 UTC

商品の説明

増山 太助 戦後期 左翼人士群像

Inflation-indexed Securities: Bonds, Swaps and Other Derivatives by Mark Deacon写真で示している1箇所だけ汚れがありますが、未使用に近い状態です。この本の内容が難し過ぎて、全然読めませんでした。ご縁のある方に譲りたいと思います。以下は引用です。The global market for inflation-indexed securities has ballooned in recent years, and this trend is set to continue. This book examines the rationale behind issuance and investment decisions, and details the issues facing anyone who designs indexed securities, illustrating them wherever possible with actual examples from the international capital markets. In particular, an extensive review of indexed debt markets throughout the world is provided - including for the first time, a comprehensive and consistent set of cash flow and price-yield equations for the instruments already in existence in the major bond markets - forming an important reference for those already experienced in the field, as well as practitioners and academics approaching the subject for the first time.

| カテゴリー: | 本・雑誌・漫画>>>本>>>ビジネス・経済 |

|---|---|

| 商品の状態: | 未使用に近い |

| 色: | ブルー系/オレンジ系 |

| 配送料の負担: | 送料込み(出品者負担) |

| 配送の方法: | 佐川急便/日本郵便 |

| 発送元の地域: | 東京都 |

| 発送までの日数: | 2~3日で発送 |

商品の情報

カテゴリー

10-Year 0.625% Treasury Inflation-Indexed Note, Due 1/15/2026

Inflation, consumer prices for Japan (FPCPITOTLZGJPN) | FRED | St

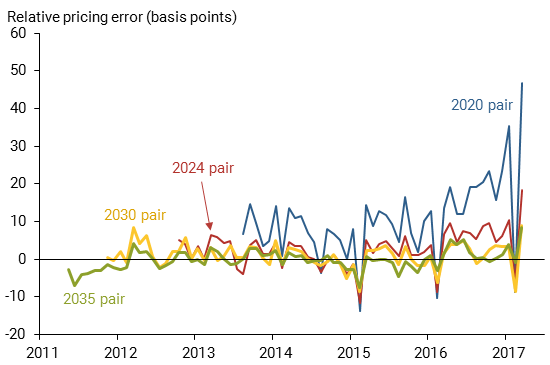

Do Adjustment Lags Matter for Inflation-Indexed Bonds? - San

Analyze Inflation-Indexed Instruments - MATLAB & Simulink Example

File:Inflation-Indexed Government Bond Yield.png - Wikipedia